What is Medicare?

Medicare is a federal health insurance program for people who are 65 years old, younger people with disabilities and people with end-stage renal disease. Once you are in Medicare you will receive a card that looks like this.

Part A (HOSPITAL INSURANCE)

Part A Covers

-inpatient hospital stays

-care in a skilled nursing facility

-hospice care

-home healthcare

You usually don’t pay a monthly premium for Part A if you or your spouse paid Medicare taxes for 10 years or 40 quarters while working. This is sometimes called “premium-free Part A.”

If you don’t qualify for a premium-free Part A, you can buy Part A.

Part B (MEDICAL INSURANCE)

Part B Covers

-doctors’ services

-outpatient care

-medical supplies

-preventative services

Most people will pay the standard Part B premium amount. The standard Part B premium amount in 2024 is $174.70 per month. If your modified adjusted gross income is reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMMA is an extra charge added to your premium.

In 2024, you pay $240 for your Part B deductible. After you meet your deductible for the year, you typically pay 20% of the Medicare-approved amounts for doctor services, outpatient therapy, durable medical equipment.

Medicare Part D (Prescription Drug Coverage)

Helps cover the cost of prescription drugs (including many recommended shots or vaccines.)

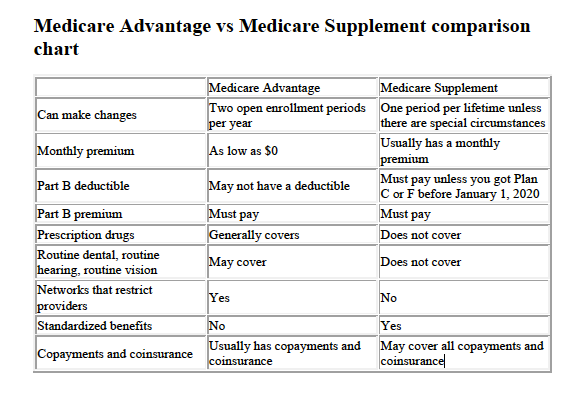

Medicare Part C/ Medicare Advantage

Medicare Advantage Plans are a type of Medicare health plan offered by a private company that contracts with Medicare to provide all your Part A and Part B benefits. Most Medicare Advantage Plans also offer prescription drug coverage. If you’re enrolled in a Medicare Advantage Plan, most Medicare services are covered through the plan. Your Medicare services aren’t paid for by Original Medicare. Below are the most common types of Medicare Advantage Plans.

- Health Maintenance Organization (HMO) Plans

(You will need referrals from the primary care doctor. Services rendered must be in-network.)

- Preferred Provider Organization (PPO) Plans

(You don’t have to get a referral from your primary doctor to see a specialist in PPO plans. If you use plan specialist, your cost for covered services will usually be lower than if you use non-plan specialist.)

- Private Fee for Service (PFFS) Plans

(PFFS Plan that has a network, you can also see any of the network providers who have agreed to always treat plan members. You can also choose an out-of-network doctor, hospital, or other provider, who accepts the plan's terms, but your costs will usually be lower if you stay in the network.)

- Special Needs Plans (SNPs)

(SNPs tailor their benefits, provider choices, and drug formularies to best meet the specific needs of the groups they serve. These plans are for Medicaid/Medicare DSNP, Chronic Conditions CSNP)

Medicare Supplement/Medigap

Medigap is Medicare Supplement Insurance that helps fill "gaps" in Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

• Copayments

• Coinsurance

• Deductibles

We are Independent Insurance Brokers who have partnerships with top companies like United Healthcare, Humana, Aetna, Cigna, Anthem Blue Cross Blue Shield, Wellcare, CarePlus, Baycare, Devoted, Freedom/Optimum, Ultimate, Mutual of Omaha, Thrivent Insurance, Guarantee Trust Life and many more.

Contact us to speak to a licensed insurance broker at a no cost consultation.

.png)